New ‘city’ in South Africa to break ground in early 2025

Advertising

14-10-2024

Read : 1204 times

Business Tech

Source

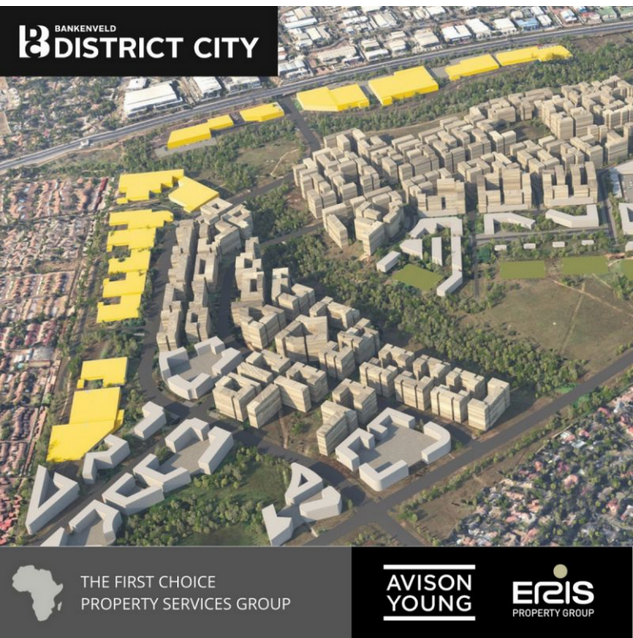

Construction on the Bankenveld District City will start in the first quarter of 2025.

In its financial results for the six months ended 31 August, Calgro M3 confirmed that the land for the Bankenveld District City was transferred to the joint venture between it and Eris Property Group in September 2024.

The group added that bulk and link infrastructure construction will commence in Q1 2025.

Calgro M3 will also fund 60% of the first phase of bulk and link infrastructure, which will cost R250 million.

“The availability of bulk infrastructure on large-scale developments is critical for an integrated developer like Calgro M3.”

“In the case of Bankenveld, where major infrastructure upgrades have already been completed

in the surrounding areas, this is advantageous.”

The group said the development will create over 20,000 housing opportunities and unlock over R18 billion in revenue over its lifecycle.

Bankenveld is a joint venture that is 50% owned by Calgro M3 and Eris.

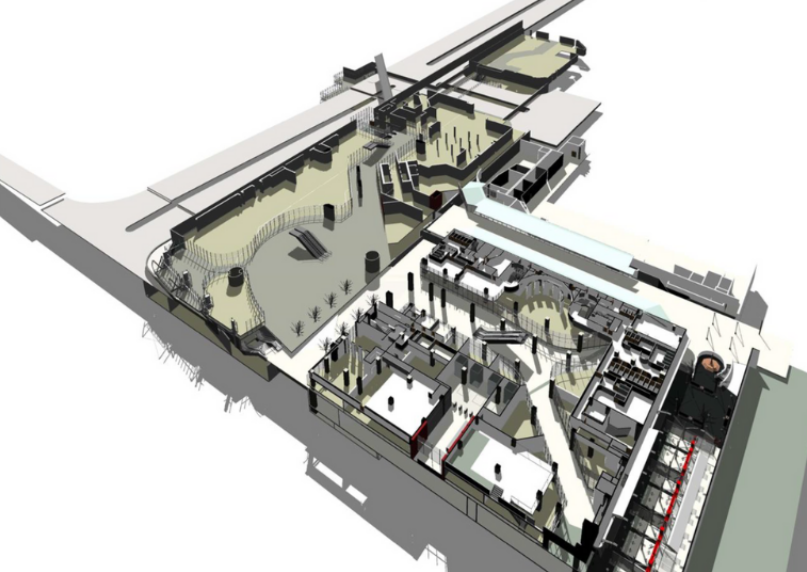

On top of the 20,000 housing units, there will be commercial, retail and industrial spaces.

The ‘city’ will be between Sandton and Waterfall in Johannesburg and accessible via the M1 and N3 highways. It is also adjacent to the Marlboro Road Gautrain station.

Calgro M3 and Eris will share the cost of infrastructure installation.

After this, Calgro will be responsible for all residential components developments, while Eris will handle all commercial, retail, industrial and healthcare components.

Financials

When it comes to the group’s results, there was a decrease in revenue for the period under review, which was primarily driven by reduced unit sales due to pressure on the already-constrained consumer and delayed transfers.

That said, the group still banked over R200 million in cash during the first two weeks of September.

“During the period, 869 units (August 2023: 1,193 units) were handed over, while 1,539 units are under construction, with the majority expected to be completed by the end of February 2025.

“We intend to commence with a further 1,592 units shortly that are targeted for completion in the next financial year.”

The group said that the growth in gross margin to 29.69% shows a strategic move to a higher mix of open market and non-public sector units, as well as the project and product mix, which benefits from historic land and infrastructure costs.

Although the number of units handed over was slightly lower than in the previous period, the group said that the positive product mix and lower infrastructure costs offset this reduction, leading to an improved gross profit margin.

The margin is also expected to remain above the short- to medium-term target.

The group’s national average sales price for its core two-bedroom family apartment was R636 617, excluding VAT.

Returning to financials, earnings per share increased to 101.40 cents per share (August 2023: 78.88 cents per share), while headline earnings per share also increased to 101.40 cents per share (August 2023: 78.88 cents per share).

Again, the group did not declare an interim dividend.

Recent News

Here are recent news articles from the Building and Construction Industry.

Have you signed up for your free copy yet?